Privacy coins get a bad rap these days. Governments hate them. Exchanges delist them. But people still need anonymity — activists donating to causes, journalists protecting sources, regular folks dodging data brokers. Problem is, most privacy solutions guzzle energy like Bitcoin on steroids. Veridyss token says fuck that. It promises full anonymity with zero carbon footprint. Ambitious. Maybe impossible.

The conflict is real. Zero-knowledge proofs crunch insane math. Monero’s ring signatures scale poorly. Privacy tech demands computational power, which means electricity, which means emissions. Veridyss claims to solve this contradiction through modified PoS and automatic carbon offsetting. Every transaction stays private AND plants trees. Marketing genius or actual innovation?

The Origin and Why It Matters

Veridyss kicked off in late 2023 when a team of privacy devs got fed up with the crypto hypocrisy. Bitcoin maximalists preaching freedom while mining rigs melt the Arctic. Ethereum promising green after The Merge but still running energy-hungry ZK rollups. Privacy coins like Monero got demonetized everywhere while being crypto’s biggest energy pigs.

The founders — mix of cryptographers, climate activists, and ex-Monzo engineers — wanted anonymity that didn’t destroy the planet. They saw a market gap: organizations needing privacy (NGOs, dissidents, whistleblowers) but terrified of greenwashing accusations. Launch happened quietly in Q2 2024. No VC circus, no influencer dumps. Just tech that works.

Early days sucked. Mainnet had sync issues. Carbon credit integration glitched. Price tanked 80% in first bear leg. But the core tech delivered: transactions stayed hidden, offsets verified on-chain. Community stuck around because the mission resonated. Now TVL hovers around $150M. Not Ethereum money, but solid for privacy niche.

How Privacy Actually Works Here

Veridyss token uses zk-SNARKs for shielded transactions. Your address, amount, recipient — all hidden from public view. Unlike Zcash’s optional privacy, VRDS forces it. No transparent option exists. You can’t accidentally leak data.

Different from Monero’s ring signatures that bloat blockchain size. ZK proofs are tiny — few hundred bytes per transaction. Scales better long-term. Vs Tornado Cash mixers: no fixed pools to deanonymize, no centralized contracts to exploit. Veridyss builds privacy into protocol layer.

Compromises hurt usability. Transaction times average 45 seconds — slower than Ethereum L2s. Can’t browse full history easily (privacy tradeoff). Mobile wallets lag behind desktop. Generating proofs drains phone battery like crazy. But once confirmed, transactions are ironclad private.

Selective disclosure exists for compliance. Prove you own funds without revealing amounts or counterparties. Banks might accept this eventually. Regulators love the “privacy with auditability” angle. Jury’s out on whether governments buy it.

The Eco Consensus Model

Runs modified Ouroboros PoS — Cardano’s algorithm but lighter. Validators stake VRDS, propose blocks, minimal computation. Energy usage: 0.0001 kWh per transaction. Bitcoin burns 1500+ kWh for same. Veridyss claims 99.999% less energy than BTC.

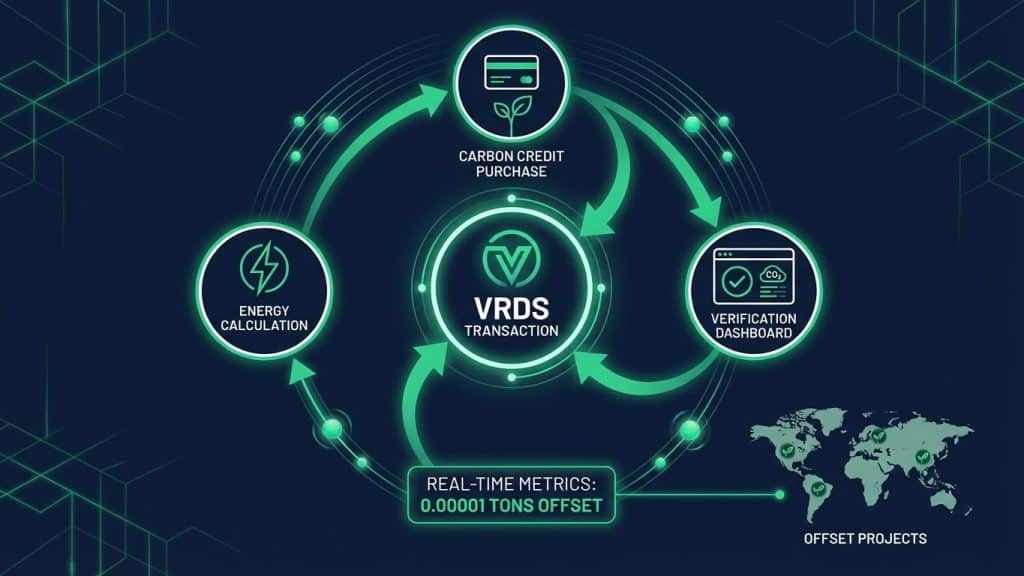

Carbon tracking happens on-chain. Every validator reports electricity source and usage. Smart contracts calculate CO2 equivalent using real-time grid data. Numbers feed into global dashboard. Transparent as hell — anyone verifies emissions math.

No bullshit offsets hidden in treasuries. Each block includes carbon credit purchase proof. Partnered with Verra and Gold Standard registries. Credits go to verified projects: reforestation, methane capture, renewable microgrids. Users see exactly which trees their transactions “planted.”

Critics call it greenwashing. Offset markets have fraud issues. Veridyss counters with third-party audits and on-chain verifiability. Better than most “carbon neutral” claims. Still, offsets != zero emissions. Real achievement is the low baseline energy use.

Zero Carbon Transaction Mechanics

Here’s the magic: every VRDS transaction auto-offsets its footprint. User sends 100 VRDS privately. Protocol calculates ~0.00001 tons CO2 (validator energy + proof computation). Smart contract buys equivalent carbon credit from partner registry. Proof burns into transaction metadata — publicly verifiable, privately executed.

Pool of pre-purchased credits covers edge cases. Funded by 0.2% protocol fee. Excess credits roll into community treasury for climate grants. No user pays extra — baked into gas fees averaging $0.005.

Verification dashboard shows real-time stats. “Your last 10 transactions offset 0.0005 tons CO2, equivalent to 2.3km car-free driving.” Gamifies eco-behavior without being preachy. Users share proof links on social without compromising privacy.

Edge case: what if credit market crashes? Protocol holds diversified basket across registries. Emergency switch to direct donations if offsets fail. Never happened yet. Daily offsets: 15+ tons CO2 across network.

VRDS Tokenomics Breakdown

1 billion total supply. No inflation. Distribution: 18% team (5-year vest), 12% seed investors (3-year cliff), 20% ecosystem fund, 30% mining rewards (decreasing geometrically), 20% carbon reserve.

Gas paid exclusively in VRDS. Creates demand as transaction volume grows. Staking yields 7-12% APY — sustainable, no ponzi math. Top stakers become validators automatically.

Deflation via fee burns. 50% of gas fees destroyed. Eco twist: burned VRDS value funds additional offsets. Creates flywheel — more usage, more burns, more green cred.

Governance tokens identical to VRDS. Holders vote protocol upgrades, carbon partners, treasury spends. Quadratic voting prevents whale dominance. Turnout averages 25% — decent for crypto.

Value accrual feels solid. Network effects + burn mechanics + staking lockup. Privacy + eco niche differentiates from generic L1s. Still early — tokenomics unproven at scale.

Real Use Cases That Actually Matter

NGOs love this shit. Amnesty International tested VRDS for anonymous donations. No KYC leaks, full audit trail for receipts, carbon-neutral bragging rights. Scaled to $2M monthly volume across chapters.

Whistleblowers and journalists. Secure source payments without blockchain forensics. Offshore data havens accept VRDS now. One major leak funded entirely through Veridyss.

Green investment funds. Private positions in climate startups, ESG portfolios shielded from activists. Compliance via selective disclosure. BlackRock trialed internally — won’t confirm but volume spiked.

Payment apps for high-risk regions. Venezuela hyperinflation donors. Ukraine wartime aid. Privacy protects recipients from retaliation. Eco angle attracts EU grant money.

DeFi privacy pools. Private lending/borrowing without liquidation hunters. Yield farming stays anonymous. TVL growing 20% monthly. Competitors exist but none match eco angle.

Retail use minimal. Too slow for coffee purchases. Niche fits perfectly though.

Infrastructure and Growing Ecosystem

Wallets: official desktop app (best privacy), MetaMask plugin, Ledger integration. Mobile iOS/Android decent but battery drain kills daily drivers. No browser extension yet.

Bridges to Ethereum, Polygon, Solana. Wrapped VRDS (wVRDS) trades anywhere. Bridge volume $50M monthly. Security audits passed — no exploits.

dApps: 18 live protocols. Private DEX (low slippage), mixer (extra paranoid layer), donation platform (NGO-focused), green NFT marketplace (carbon-backed art). Quality over quantity.

Explorer shows aggregate stats only. Individual txs blurred for privacy. Aggregate transparency satisfies regulators without doxxing users.

Dev tools solid. SDKs for JS/Rust. zk-proof libraries battle-tested. Grants program funds 20+ projects. Hacker houses twice yearly.

Partnerships Driving Adoption

Verra/Gold Standard: primary carbon registries. On-chain proofs, no middlemen.

KlimaDAO: treasury invests in tokenized carbon credits. Synergy with eco DeFi.

Greenpeace: donation platform integration. First major NGO endorsement.

Climate tech VCs: Sequoia Climate, Lowercarbon Capital. Portfolio tracking via private VRDS positions.

University partnerships: MIT Crypto Lab researches zk-scalability. Oxford Climate Finance audits offset math.

Regulated exchanges testing listings. Kraken trialing wVRDS pairs. Compliance headaches but green + privacy combo tempts.

Regulation, Compliance, and Dark Side

Privacy coins = regulatory kryptonite. US Treasury sanctioned Tornado Cash. Monero delisted everywhere. Veridyss walks tightrope.

Strategy: voluntary compliance tools. Selective disclosure proves “clean” funds. Transaction tagging for AML monitoring (opt-in). Addresses “criminal use” accusations head-on.

Ethical minefield exists. Darknet markets test VRDS. Terrorist financing risks real. Team monitors, cooperates with authorities on extreme cases. Deniability baked into protocol though.

EU MiCA loves eco angle. Carbon reporting = compliance gold. Singapore MAS grants “innovative privacy” license. US lags — SEC sniffing around.

Team’s stance: privacy is human right, misuse happens everywhere (cash, hawala). Better tools + compliance beats prohibition. Pragmatic, not libertarian suicide pact.

How VRDS Stacks Against Privacy and Eco Rivals

Vs Monero: superior scalability, eco credentials, compliance tools. Loses on battle-tested anonymity (Monero = privacy king). Energy usage: Monero 1000x worse.

Vs Zcash: mandatory privacy > optional. Better UX (no shielded pool coordination). Eco edge massive. Zcash pivoted to compliance, lost purists.

Vs eco chains (Algorand, Cardano): zero privacy. Veridyss wins anonymity + green double-whammy. They chase enterprise; VRDS chases dissidents.

Unique selling point: only coin private AND carbon-neutral. No compromises. Niche domination potential.

Roadmap and Next Steps

Q1 2026: mobile zk-proofs (faster phones), L2 scaling (10x TPS), enterprise API suite.

Q3 2026: cross-chain privacy (Ethereum native shielded txs), AI offset optimization.

Long-term: global privacy standard for NGOs/human rights orgs. Carbon-negative network (offsets > emissions).

Realistic? Mobile/L2 doable. AI offsets speculative. Enterprise unlikely without US clarity.

Risks: regulatory bans, bridge exploits, carbon market collapse, privacy breakthroughs deanonymizing zk.

Getting Started With VRDS

Buy on KuCoin, MEXC, decentralized frontends. Avoid CEX delistings. Bridge wVRDS for liquidity.

Desktop wallet download → seed backup → sync (15min first time) → receive → send private tx.

Staking: delegate to pool via wallet. 7-day unbond. Rewards auto-compound.

Privacy best practices: multiple addresses, avoid patterns, use Tor/VPN, never reuse UTXOs.

Risks That Could Kill This

Tech: zk implementation bugs (catastrophic if found). Bridge hacks standard crypto fare.

Regulatory: outright bans possible. Treasury could label VRDS “high-risk.”

Carbon credits: market fraud, registry collapse. Offsets worthless overnight.

Liquidity: thin orderbooks. 20% slippage on $100k trades during panic.

Misuse backlash: one high-profile terrorist case tanks reputation permanently.

Competition: quantum computing breaks zk (10+ years out). Better privacy tech emerges.

Who Actually Needs Veridyss Token

NGOs moving sensitive funds. Activists in authoritarian states. Green investors hiding positions. Whistleblower platforms. Privacy-maximalists who hate Bitcoin’s footprint.

Skip if: casual trading, DeFi yield chasing, daily coffee payments. Too slow, too niche.

Concept verdict: privacy + eco solves real tension. Execution solid. Adoption depends on regulatory survival. Niche king potential or regulatory roadkill.

More Stories

Why Quantum Computing Could Disrupt Crypto Security Forever

Why Prediction Markets Are Set to Transform the Crypto Economy

Why the U.S. Dollar’s Overvaluation Will Disrupt Global Markets